Personal Finance

Confused By Personal Finance? Check Out These Tips!

Money and the way you handle it has an impact on every other facet of your life. You must take charge of your finances to be successful in control. The following tips in this article will help you on the path to proper money management and make saving money a snap.

If you’re in a foreign country, eat where the locals eat. Hotel restaurants should only be your last resort. Do some online research, or ask around, and find some great local places to eat. You can find tastier food for less.

The restaurants in your hotel and in the area surrounding it are going to be overpriced, that is why it is good to research on places on where locals eat. You can actually find better tasting food that is cheaper and tastes better.

Times are tough, and it can be a good idea to keep your savings in a number of places. Savings accounts, high-interest savings accounts or checking accounts, regular checking accounts, money-market accounts, stocks and gold are all sound places to keep your money. These are all ideas on how you can safeguard your investments and money.

In these turbulent times, spreading your savings around into multiple areas is a good idea. Put some in a pure savings account, more in a checking space, invest some money in stocks or gold, and even gold. Use a combination of several of these approaches to limit your money.

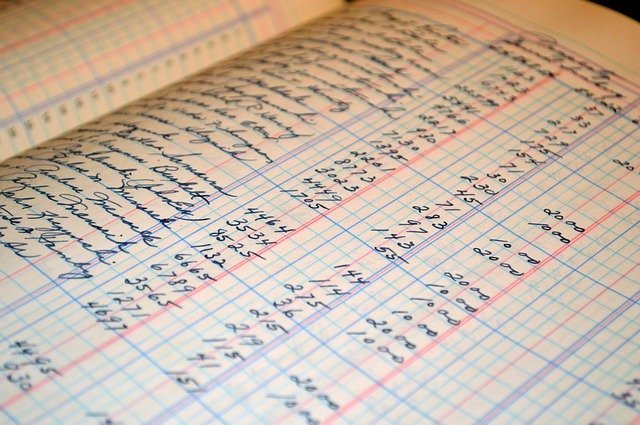

Keeping a log of exactly what you spend on a daily basis will allow you to figure out exactly where your money is going. A notebook that is easily set aside or lost is probably not the best method, as it is often soon forgotten. Try using a whiteboard in your den or home office to document your finances. That way, you see it more frequently.

Credit Score

The best way to stay one step ahead of financial problems is to advance plan for your future. Having this detailed plan will be a motivator for you also, as it will encourage you to work more diligently or decrease miscellaneous spending.

If married, use this to your advantage. If you need to improve your credit score, you can build it back up by paying off credits each month. When both of you get your credit score to a good level, you can start to apply for joint loans and share the debt with your spouse.

If some of your debts are in collection, you should know that there is a statute of limitations for collecting on debts. Consult a credit expert about the statute of limitations on your debt. Avoid paying on old debts.

Make savings your first priority each time you are paid.

Eating out less can save a ton of money over the course of a year. Providing a home cooked meal for your family will not only save you money, but will also give you a feeling of accomplishment.

You can’t repair your credit before you get out of debt. You can decrease your monthly expenses by eating at home and limiting yourself from going out on weekends.

The first step to credit repair is to get out of debt. To do so, cutbacks must be made. This will allow you to pay off loans and credit accounts. Consider cooking your own food or limit hanging out on weekends. If you take your lunch to work and do not eat out during the weekend, you can save lots of money. If you are serious about having good credit, you will need to make a commitment to reduce your spending.

Don’t take out huge amounts of student loan debt without being in a position to repay it. If you are planning on sending your child to a private school, then you could wind up in a large amount of debt.

You can sell an old laptop if you’re trying to earn a little extra money this month. A broken laptop is worth a little something, and one that is working or fixable is worth even more. Even selling a laptop that’s busted can give you enough money to put gas in your tank.

Try making presents instead of wasting all your money on store bought things. This can lower your visits to stores and save you hundreds during the holiday season.

Do not underestimate the role that a balance on a credit card will have in regards to your FICO score. The closer you are to your credit limits, the worse the impact on your score is going to be. Your score will go up as the balance goes down. Keep your balance below 20% of the total credit you have.

Be certain to pay utility bills get paid on time each and every month. Paying bills late can damage your credit. You may also be charged a late fee, adding to your bill.Paying your bills in a timely manner is the best way to use your finances.

Set aside a cash allowance that you can use for small personal purchases. Use the budget to purchase things that you want. When you hit your budget limit for the month, you should understand that you are done with entertainment purchases until the next month’s budget begins. Your budget will remain in tact, and you’ll still be fairly happy.

You will find that the way you are managing your finances will merge into all aspects of your life. Some simple steps can help you manage your personal finances.

Keeping your tax information well organized throughout the year will make tax time less stressful. By having all your finance-related paperwork files together, you can quickly and easily find what you need at tax time.