Credit-Cards

Ways You Can Get The Most Out Of Your Charge Cards

Charge cards can help people build up their good credit and managing money. Knowing how the card works and the laws that govern it will allow one to make smart choices. The credit card tips that follow are meant to help consumers make educated decisions when they choose to use plastic.

Do not close credit card accounts before you understand the impact it will have on you.

You should only open up retail credit cards if you plan on actually shopping at this store on a regular basis. When a retail store inserts an inquiry onto your credit in order to qualify you for a card, this is recorded onto your credit report regardless of whether you actually open up the card. Repeated applications for credit could negatively affect your overall credit score.

You can save a lot of trouble by setting up automatic payments through your bank or credit card company.

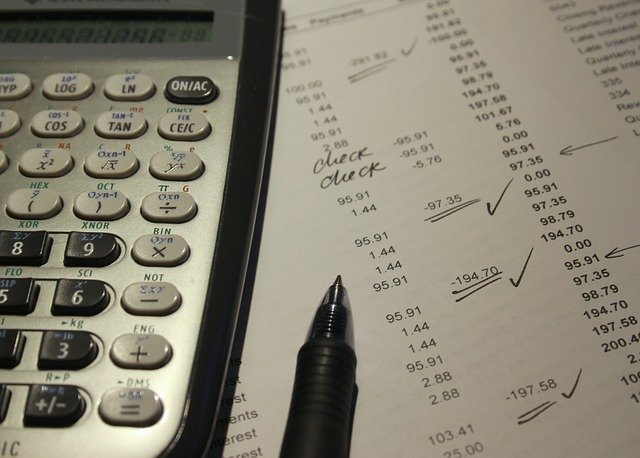

Make sure you set up a spending budget when using your bank cards. You need a budget for the money you make; therefore, so include credit cards in that budget. You do not want to think of a credit card as extra spending money. Set aside a limit for yourself on how much you are able to spend for your card every month. Stick with it and be sure to pay it every month.

Pay for your credit card on time every month so that you can maintain a high credit score. Your score is damaged by late payments, and that also usually includes fees that are costly. Using automatic payment features for your credit card payments will help save you both money and time.

Credit Card

Always read emails or letters from your credit card. You can cancel a credit card if you disagree with any changes.

Remember that when you are dealing with a credit card company, their minimum payment structure is designed to keep you paying compounding interest for years and years to come. Always pay above the minimum. Over time, this will help you to avoid paying so much out in interest.

Don’t believe that any interest rate is non-negotiable. Credit card companies normally have several interest rates they can use at their discretion. If you dislike your interest rate, contact your bank or credit card company and ask for a better rate.

If they decline, try looking for cards at a different company. After you find one, transfer your debt to the new card.

Avoiding late charges is important, but you also want to avoid going over your limit because you will be charged for that as well. Both fees can be very pricey, both to your wallet and your credit report. Monitor things closely, and never exceed your personal limit.

You want to avoid switching to another credit card account unless it is unavoidable situation. The amount of time that your account has been open will have an individual creditor is factored into your credit score. Keeping your accounts open whenever possible is one element of building a good credit history.

Cash Advance Fees

Set a budget that you can stick to. You should not max out your card just because a certain amount is available on your card. Be aware of what you should set aside for each month so you may make responsible spending decisions.

Some fees that you may overlook include the annual fee, cash advance fees or service charges, cash advance fees and service charges.

If you have good credit, yet are paying a high annual percentage rate, contact your credit card issuer and ask them to lower it. This trick can save you hundreds of dollars a lot every month that you carry a balance.

Keep your credit in a good state if you would like to be eligible for the best credit cards. Credit card companies use those credit scores for determining the cards to offer customers. The very best cards are only given to consumers who have very high credit scores.

Some people are tempted to spend way more than what they can pay for. These type of people should think twice before applying for a credit card. When they are opening an account, they are prone to have a terrible financial future.

Never pay a credit card with a credit card. The charges that result from this will just make next month’s emergency even bigger.

Don’t use your credit cards to purchase items that you can’t afford. Just because you want a new flat-screen TV, doesn’t mean a credit card is the best way to buy it. If you cannot pay the charges off at the end of the month, you will pay a lot of interest and may run the risk of not being able to afford the monthly payments. Make decisions only after thinking them over for a couple of days. If you decide that it is still worth purchasing, look into the retail store’s financing offers.

Making exceptionally large purchases and traveling are examples of situations where you need to give them advance notice. This will suspect identity theft and suspend your account.

Use bank cards on a regular basis so that your accounts are not closed. If they lie dormant, your creditor may shut down your card.

If you have bad credit, try to get a secured card. These cards require some kind of balance to be used as collateral. Functioning in many ways like a debit, your money stands as insurance that you won’t go crazy and max your cards out. This is not a perfect situation, but it can help rebuild damaged credit. If you want a secured credit card, stick with large, well-established credit card companies. They may later offer an unsecured card to you, and that will boost your credit score even more.

When looking for a credit card, you should try and go with a larger credit card company.

Using many different cards can put too much information out there.

Try to avoid closing accounts. It might seem obvious, so you can increase your credit score; however, if you close accounts, it can turn out to be bad for the score. When you close an account, the amount of overall credit you have is lowered, and this could make your current lending ratio percentage higher.

Keep this type of that information in a secure location. This will ensure that you can provide accurate and complete information to the issuing company, if someone’s wallet is lost, or your purse snatched. Reporting lost or stolen bank cards immediately will prevent you from having to be responsible for the fraudulent charges fraudulently incurred.

Be careful when charge cards that try and tease a zero percent rate. Although a zero interest offer could be enticing, keep in mind that the interest rate and balance will skyrocket once the introductory period ends. Always keep track of your balance if you intend to use the card.

When you receive your credit card accounts, check them carefully rather than just filing away without a second glance. Look for any errors with the charges that you made and make sure there are no unauthorized charges. Report any mistakes to the credit card company as soon as possible. Initiating a dispute promptly can save you money and also help to protect your credit score.

Avoid rewards cards if you don’t have any credit experience. These cards encourage excessive spending to get rewards, which can quickly lead to problems.

If you incur a late fee on your credit card, give the company a call and ask them to remove it.

Never provide your card number online or over the phone without really knowing the company that you are in contact with. When receiving unsolicited requests for credit card numbers, be very cautious. There are a lot of scams that people try to use to collect credit card numbers. Keep your credit card information save by being alert for scams.

Never go to an ATM to get cash advances or use a credit card for gambling transactions. Credit card companies will charge huge fees for cash advance from it.

Bank Cards

When you owe more than you can pay, you can end up having financial difficulties in the future. Poor credit will interfere with your ability to do things such as buy a new car or rent an apartment. You may even be barred from some jobs if you have poor credit.

As was mentioned earlier, bank cards can be a great tool for managing finances. However, take the time to truly understand the bank cards and what they can do to help you, so you are able to make informed decisions. If you understand the basics of how charge cards work, you can make better decisions regarding credit.