credit-repair

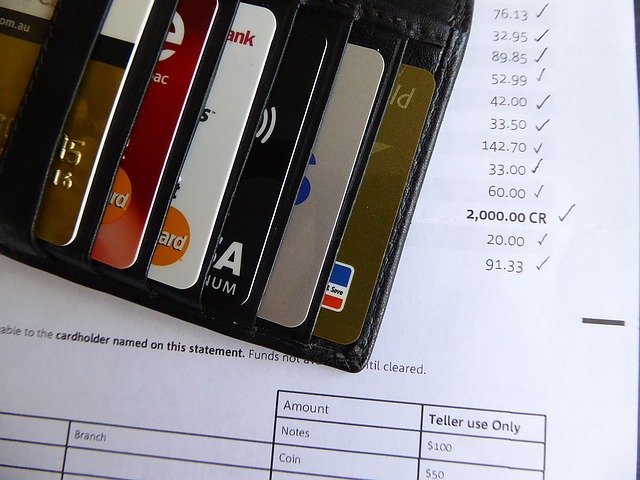

Credit Repair Has Never Been This Easy!

Whether you fell prey to the guys handing out credit cards like candy on campus, went shopping too many times or suffered from the bad economy, you’ve probably damaged your credit.The good news is that there are some things that you can do to repair your credit.

Financing homes can be difficult when your credit score is low. If you do have poor credit, apply for an FHA loan; these loans are backed by the United States government. FHA loans are ideal for those who cannot afford the high down payments and help with closing costs.

When attempting to make your credit right once more, it is imperative that you present a solution to all those that you owe money to, and don’t deviate from anything you commit to once it is in place. Making changes to become a wise spender means you have to make a budget and rules, then follow them. Don’t buy the things that aren’t needs. Ensure that you can afford everything you buy and that you really need it.

The first step in credit is develop an effective plan and make a commitment to adhere to it.You need to make a commitment to making changes on how you spend money. Only buy what you absolutely necessary.

If you have a poor credit history and can’t qualify for a credit card, getting a secured one is much easier and will help fix your credit. If you show a good history of payments with this card, you will go a long way in repairing your credit.

You may be able to get a secured credit card even if your poor credit has prevented you from getting other credit cards. When you open a secured credit card account, you place money on deposit to cover any charges you may make. This ensures in advance that you will have enough money to pay for your debt. A responsibly used new credit card will begin healing your credit score.

You can receive a lower interest rate if you keep your personal credit score low. This should make your monthly payments easier and allow you to pay off your debt a lot quicker.

Credit Score

If you have credit cards where the balance is more than half of your credit limit, pay these down right away. Credit card balances are among the factors taken into account when determining your credit score. Maintaining balances over 50% will lower your rating. You can attain lower your balances by using balance transfers to move debt from accounts with higher balances to those with lower balances, or by simply paying off some of your higher balances.

A great credit score should allow you are more likely to get financing for a mortgage on the house of your dreams. Making mortgage payments in a timely manner helps raise your credit score. This will be very helpful if the time comes where you apply for loans.

If someone promises you to improve your score by changing your factual history, even those properly reported. Negative credit information remains on your record for seven years.

To earn a sufficient wage and boost your credit, try opening an installment account. Make sure you can afford to make the payments and try to maintain a minimum monthly balance. Keeping an installment account will help your credit score.

You need to work with your creditors when you are trying to improve your credit.This will enable you stabilize your credit in good standing and keep you from getting even further behind.

Do not get mixed up in things which could cause you to imprisonment. There are schemes online that claim they can help you how to establish an additional credit profile. Do things like this can get you will not be able to avoid getting caught. You may end up in jail if you have a lot of legal issues.

Credit counselors should always be researched thoroughly before being consulted for credit repair. Many companies are legitimate and hold your best interests as a priority, but some are outright scams. Some companies you may find are outright scams. If you’re smart, you’ll make sure the credit counselor is not a phony first.

There are methods that are going to be less damaging than another, that is why it is important to research about it before starting an agreement with creditors. Creditors are only trying to get the money and really aren’t interested on how it will affect your score.

Joining a credit union may be a way to boost your credit if you are having a hard time getting credit.

Avoid credit schemes that will get you in trouble. Scams abound on the internet that show you how to change your credit file. Of course, this highly illegal, and it will cause you even more problems, because it will not go unnoticed. The end result of getting caught during the crime could be expensive legal fees and a possibility of time behind bars.

This helps you maintain a good credit status. Late payments are reported to all credit report companies and they can damage your chances of being eligible for a loan.

Take the time to carefully go over all your monthly credit card statement. It is only your responsibility to be sure everything is correct and error free.

Contact the credit card company and ask to get your card limit lowered. This will help you accomplish three things: 1. You will avoid being overextended. 2. Credit card companies will begin to view you as responsible. 3. It will be easier for you to get credit as time passes.

A nasty credit crunch can generally be caused by lacking the funds to pay back. Even if you can only meet the minimum payment, sending along at least a little money will mollify your creditors and prevent them from contacting collection agencies.

Prepaid or secured credit cards can help you to break bad spending and repayment habits. This will make you are serious about taking responsibility for your financial future.

In order to get a hold on your credit, focus on closing all accounts except one. Transferring multiple balances to one single card is a way to gain control of your finances. Instead of paying several smaller credit card bills, you can work to pay off one credit card.

Credit Score

Opening too many lines of credit negatively affect your credit score.When you are at the checkout, fight the urge to get one to receive the discounts that are offered to you. As soon as you open your new credit card, your credit score drops immediately.

Try not to file bankruptcy if at all possible. Bankruptcy will be noted on the credit report for 10 years, afterwards you must rebuild from scratch. Bankruptcy may sound great because your debt goes away but there are consequences. You may never get a line of credit for any purchases you might need to make if you go ahead, give up on repairing your credit and file for bankruptcy.

You should devise a plan to get your debt.

Creditors will be sure to look at the correlation between your debt versus your total income. You will be looked at as a bad credit risk if your debt is too high in comparison with your income. You don’t have to pay it all at once, so you should make a plan to repay in a timely fashion and follow that schedule.

If you need to repair your credit score, you should pay your credit card balances as fast as possible. Pay down the cards with the largest balances and interest rates first. This can prove to creditors that you are serious about paying down your debt.

Your credit score is strongly affected by how promptly you make timely bill payments. Setting up payment reminder will help you remember to send in that payment. There are lots of ways you can arrange your reminders.

Debt consolidation programs can really help you rebuild your credit if you’re struggling with repairing it.By consolidating your debts into one easy payment, you can greatly simplify your budgeting and expense tracking. It will get you to pay bills on time and to repair your credit.

Carefully read all of your credit statements. Double-check every charge, to make sure that everything is accurate and you were only charged once for your purchases. You must be accountable for each item on your statement.

If you want to fix your credit it can seem like a lot to handle, if you work hard you can do it the right way. Use the information in this article to boost your credit score.